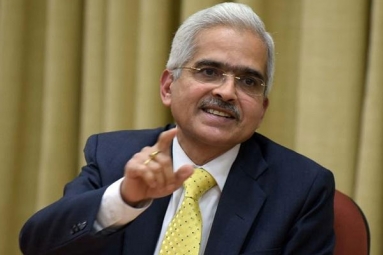

RBI may raise $30-35 Billion through NRI Bonds to Support Rupee: Report

June 12, 2018 08:43

(Image source from: Moneycontrol)

The Reserve Bank of India through Non-Resident Indian bonds expects to hike USD 30-35 billion to aid the rupee and commence the slowdown in Foreign Portfolio Investment (FPI) flows amid emerging oil prices, says a report.

The FPI inflows to India will be impacted by Chinese firms listing in global benchmark indices like MSCI, it said.

According to a report by Bank of America Merrill Lynch (BofAML), the listing in benchmark indices will shift up to USD 100 billion to China market by 2019.

"Our China strategists estimate that possible entry into benchmark indices could push up to USD 100 billion into the China markets by end-2019. FPI equity flows to India may slow amid political uncertainty in the run-up to the general elections, given rich valuations," Bank of America Merill Lynch (BofAML) said in a research note.

It further said that "We grow more confident that the RBI will issue the fourth tranche of NRI bonds to raise, say, USD 30-35 billion, to offset a slowdown in FPI flows on the listing of China paper in various benchmark indices at a time of higher oil prices," the report noted.

NRI bonds are forex deposits with some lock-in and an implicit RBI guarantee elevated from NRIs at attractive rates for 3-5 years.

RBI will issue NRI bonds if the global oil prices prevail at USD 70/bbl. BofAML oil strategists forecast USD 71.8/bbl for 2018-19 and USD 75.3/bbl for 2019-20 and accordingly the actual account deficit will increase to 2.4 percent of GDP this fiscal from 0.7 percent in 2016-17, the report noted.

"We think that there is a rising case for issuing NRI bonds. Every NRI bond issuance has been effective in curbing Indian Rupee volatility," the report noted.

The report further noted that the RBI is hoped-for to follow an asymmetrical policy of purchasing forex when the USD weakens and defending Rs66/USD when it strengthens. On the rupee, which has been falling against the US dollar, BofAML said its strategists see the Indian currency at Rs 69.75/USD by December. The rupee is currently hovering around Rs 67/USD.

By Sowmya Sangam